Harrisburg PA Mortgage Market Recap - Jan 26 2012

If you meet a home builder, don't be surprised if his gait is imbued with a little more pep and his voice tinctured with a little more enthusiasm, for his mood has likely been lifted by optimism these days.

The latest home builder sentiment index shows that builders are expecting more construction, more sales, and better pricing for 2012. The index moved up an impressive four points to 25 in January. This is the best reading since mid-2007 and marks four-consecutive months of sentiment improvement.

A cynic might counter that home builders are getting ahead of themselves. After all, housing starts did fall 4.1 percent, to an annualized rate of 657,000 units, in December. That said, a few details are worth exploring. November was an unexpectedly strong month for starts, and the fact remains that December's starts still adhere to an established uptrend. If you look back to February 2010, you'll see month-over-month improvements revealed in higher lows and higher highs.

Permits suggest more of the same going forward. Permits in December inched up 0.1 percent to an annualized rate of 679,000 units, which is a 7.8 percent improvement over December 2010. The gains aren't spectacular, to be sure, but we're not looking for spectacular, we're looking for sustainable. We think the gains are sustainable.

The trend in mortgage purchase applications has been encouraging to both home builders and existing-home sellers. Purchase applications jumped 10.3 percent in the January 13 week, the best posting in a month. Removing the holiday hiatus, the trend in purchase applications has been mostly up over the past few months.

The trend in refinance applications has also been up, and to a much greater degree than purchase applications. Refinance soared 26.4 percent in the latest reported week, hitting an activity level unseen since August 2011.

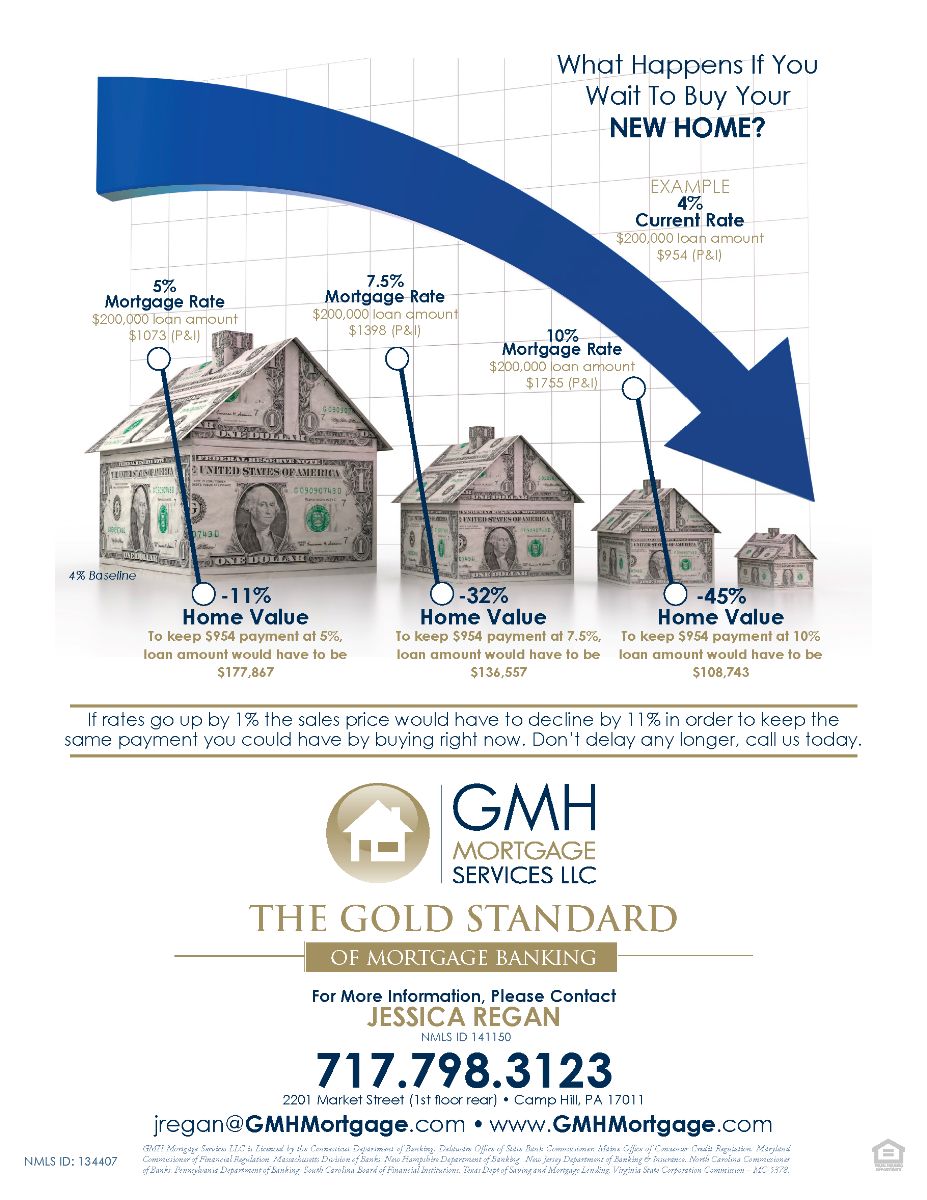

Mortgage rates inching lower to another multi-decade low was one factor in the surge in mortgage activity. But the increase in fees for loans purchased by Fannie Mae and Freddie Mac starting April 1 is the more influential factor. This increase translates to a 0.125 percent to 0.25 percent increase in mortgage cost (though some pundits argue that longer-term these are low-end estimates). The fees are already being implemented, but they've been offset by the mortgage-rate drop that has occurred over the past month.

We think the days of record-low mortgage financing are numbered. Fannie's and Freddie's fee increase will obviously raise costs. The revamped version of the Home Affordable Refinance Program, HARP 2.0, will also pressure mortgage rates higher due to a surge in mortgage demand: rising demand usually means rising costs.

Bottom line: we think it's advisable to act now on a refinance or a purchase to avoid the possibility of getting tangled in a refinance boom that many industry watchers are expecting to emerge in the next month or two.

Courtesy of Jessica Regan.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.