Housing Stocks and the Housing Market

When trying to gain insight into a market, it is important to parse what people do as much as what they say. The stock market is often a good starting point to parse what people are doing as opposed to what they are saying.

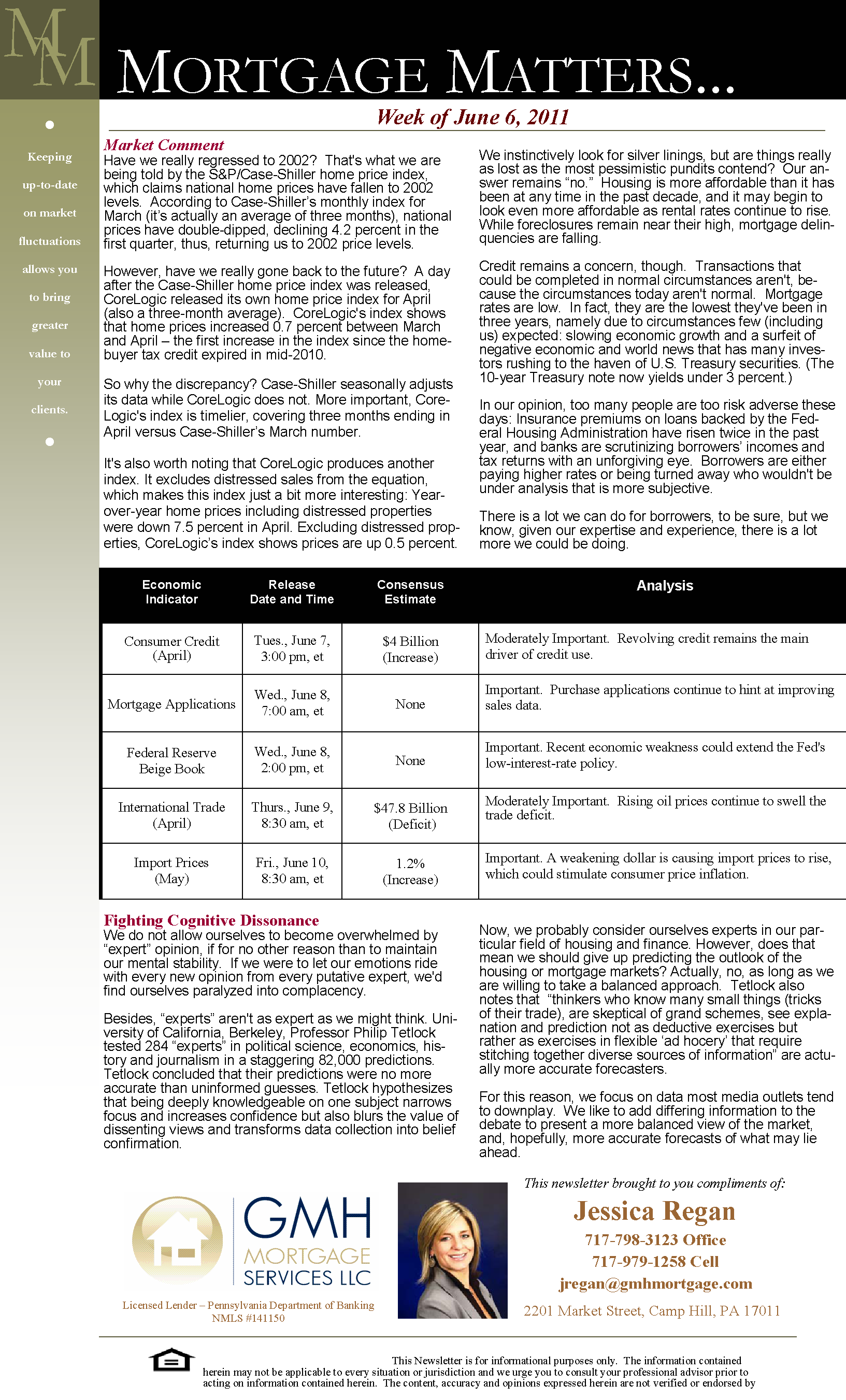

We think three particular stock investments offer insight into what investors are doing with their money regarding housing: the iShares FTSE NARIET Residential Plus Capped Index (REZ), the iShares Dow Jones U.S. Home Construction ETF (ITB), and the SPDR S&P Home builders ETF (XHB). These investments cover homebuilders, home improvement stores, construction material, furnishings, and other ancillary businesses attached to the housing market.

For most of the year, these investments have been mostly flat to slightly down, but have been rallying over the past month. What we find most telling, though, is the short interest – a measure of the number of investors who bet these shares will fall. Short interest is extremely low, and has been falling. This tidbit of information suggests to us that fewer investors are bearish on housing in general, and that many more investors (compared to last year) believe the worst is behind us.

Courtesy of Jessica Regan.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.