Recent Federal Reserve Action Improves Home Mortgage Rates

The actions by the Federal Reserve this week have benefitted current homeowners and buyers that are looking to purchase a new home. Normally, the action by the Fed does not impact residential mortgage rates since a majority of those rates are established by the open market and private investors. This time the mortgage rates have dropped significantly in the Greater Harrisburg market, and in some cases 30 year fixed rates are now below 5% and with NO POINTS. What does that mean to the a current homeowner? The difference between a 5% and 6% mortgage of $100,000 is $63.00 less per month or $756.00 a year and naturally if your balance is more than $100,000, the savings are greater to you. And if you have been considering the purchase of a home and selling yours, the savings can be just as great on that purchase.

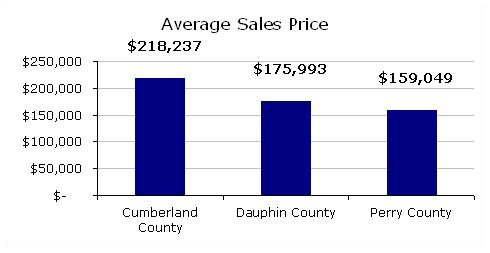

Why have the mortgage rates dropped so far? Well, the impact of the economic slowdown has not spared Central Pennsylvania, but the impact has not been as severe as in many areas of the country, but there has been a slowdown. Home sales in numbers in the Harrisburg suburbs of Dauphin and Cumberland counties for the month of November 2008 compared to November 2007 are down by 25% and the average sales price is lower by 5% over the same comparative period of time. Not good but nowhere near the figures of some regions of the country.

But I am optimistic going forward and you ask WHY? The Greater Harrisburg real estate market for the last 30 years has not seen the wild fluctuations in value, up or down, that many localities have experienced, with the exception of 2005. And I anticipate that we will return to normal valuation ranges very shortly – within six months. How does that impact you as a buyer or seller? Pricing in the market has slowed so there are deals to be had, and I do not anticipate the interest rate environment to increase within that time frame at a minimum so you are going to have extremely attractive interest rates, which in turn has a very positive impact on monthly housing costs. No one was able to time the market and intentionally find the bottom of a market, real estate costs or interest rates, so be on the lookout for value. If you need any real estate or interest rate information, please contact me. Have a happy Holiday season and a prosperous New Year.