Hampden Township in Cumberland County had the lowest property tax rates in the Harrisburg area in 2011, according to a Patriot-News analysis. If you own a home worth about $100,000 there, you would pay $1,077 in school, county and municipal taxes, according to the analysis. Compare that to Harrisburg, where a $100,000 home would set you back $3,194 in taxes, or Highspire, where it would cost you $3,408.

These are 2011 figures. Taxes will be going up in 2012 in many locations.

CUMBERLAND COUNTY

CAMP HILL

-

Population: 7,888

-

Median household income: $58,910

-

School tax: 12.96 mills

-

County tax: 2.04 mills

-

Municipal tax: 3.02 mills

-

Total tax: 18.02 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,802

-

Median value house: $187,700

-

Assessed value on median house: $187,700

-

Tax on median house: $3,382

CARLISLE

-

Population: 18,682

-

Median household income: $45,074

-

School tax: 12.26 mills

-

County tax: 2.04 mills

-

Municipal tax: 3.06 mills

-

Total tax: 17.36 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,736

-

Median value house: $163,700

-

Assessed value on median house: $163,700

-

Tax on median house: $2,842

EAST PENNSBORO TOWNSHIP

-

Population: 20,228

-

Median household income: $59,923

-

School tax: 10.31 mills

-

County tax: 2.04 mills

-

Municipal tax: .96 mills

-

Total tax: 13.31 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,331

-

Median value house: $155,900

-

Assessed value on median house: $155,900

-

Tax on median house: $2,075

HAMPDEN TOWNSHIP

-

Population: 28,044

-

Median household income: $81,498

-

School tax: 8.57 mills

-

County tax: 2.04 mills

-

Municipal tax: .16 mills

-

Total tax: 10.77 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,077

-

Median value house: $224,300

-

Assessed value on median house: $224,300

-

Tax on median house: $2,416

LEMOYNE

-

Population: 4,553

-

Median household income: $49,609

-

School tax: 9.0 mills

-

County tax: 2.04 mills

-

Municipal tax: 2.10 mills

-

Total tax: 13.14 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,314

-

Median value house: $124,700

-

Assessed value on median house: $124,700

-

Tax on median house: $1,639

LOWER ALLEN TOWNSHIP

-

Population: 17,980

-

Median household income: $58,486

-

School tax: 9 mills

-

County tax: 2.04 mills

-

Municipal tax: 1.23 mills

-

Total tax: 12.27 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,227

-

Median value house: $155,600

-

Assessed value on median house: $155,600

-

Tax on median house: $1,910

MECHANICSBURG

-

Population: 8,981

-

Median household income: $53,716

-

School tax: 12.17 mills

-

County tax: 2.04 mills

-

Municipal tax: 2.58 mills

-

Total tax: 16.79 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,679

-

Median value house: $155,800

-

Assessed value on median house: $155,800

-

Tax on median house: $2,616

MIDDLESEX TOWNSHIP

-

Population: 7,040

-

Median household income: $53,939

-

School tax: 8.57 mills

-

County tax: 2.04 mills

-

Municipal tax: .998 mills

-

Total tax: 11.61 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,161

-

Median value house: $155,000

-

Assessed value on median house: $155,000

-

Tax on median house: $1,800

MONROE TOWNSHIP

-

Population: 5,823

-

Median household income: $78,050

-

School tax: 8.57 mills

-

County tax: 2.04 mills

-

Municipal tax: .473 mills

-

Total tax: 11.08 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,108

-

Median value house: $191,700

-

Assessed value on median house: $191,700

-

Tax on median house: $2,124

MOUNT HOLLY SPRINGS

-

Population: 2,030

-

Median household income: $38,594

-

School tax: 12.26 mills

-

County tax: 2.04 mills

-

Municipal tax: 1.37 mills

-

Total tax: 15.67 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,567

-

Median value house: $113,200

-

Assessed value on median house: $113,200

-

Tax on median house: $1,775

NEW CUMBERLAND

-

Population: 7,277

-

Median household income: $50,901

-

School tax: 9 mills

-

County tax: 2.04 mills

-

Municipal tax: 2.9 mills

-

Total tax: 13.94 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,394

-

Median value house: $148,400

-

Assessed value on median house: $148,400

-

Tax on median house: $2,069

NORTH MIDDLETON TOWNSHIP

-

Population: 11,143

-

Median household income: $62,152

-

School tax: 12.26 mills

-

County tax: 2.04 mills

-

Municipal tax: .69 mills

-

Total tax: 14.99 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,499

-

Median value house: $152,000

-

Assessed value on median house: $152,000

-

Tax on median house: $2,278

SHIREMANSTOWN

-

Population: 1,569

-

Median household income: $46,979

-

School tax: 12.17 mills

-

County tax: 2.04 mills

-

Municipal tax: 1.9 mills

-

Total tax: 16.11 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,611

-

Median value house: $158,200

-

Assessed value on median house: $158,200

-

Tax on median house: $2,549

SILVER SPRING TOWNSHIP

-

Population: 13,657

-

Median household income: $72,574

-

School tax: 8.57 mills

-

County tax: 2.04 mills

-

Municipal tax: .8 mills

-

Total tax: 11.41 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,141

-

Median value house: $193,600

-

Assessed value on median house: $193,600

-

Tax on median house: $2,209

SOUTH MIDDLETON TOWNSHIP

-

Population: 14,663

-

Median household income: $67,073

-

School tax: 8.93 mills

-

County tax: 2.04 mills

-

Municipal tax: .17 mills

-

Total tax: 11.14 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,114

-

Median value house: $180,000

-

Assessed value on median house: $180,000

-

Tax on median house: $2,005

UPPER ALLEN TOWNSHIP

-

Population: 18,059

-

Median household income: $69,722

-

School tax: 12.17 mills

-

County tax: 2.04 mills

-

Municipal tax: 1.29 mills

-

Total tax: 15.50 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,550

-

Median value house: $182,300

-

Assessed value on median house: $182,300

-

Tax on median house: $2,826

WEST PENNSBORO TOWNSHIP

-

Population: 5,561

-

Median household income: $59,221

-

School tax: 12.1 mills

-

County tax: 2.04 mills

-

Municipal tax: .26 mills

-

Total tax: 14.4 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,440

-

Median value house: $149,600

-

Assessed value on median house: $149,600

-

Tax on median house: $2,154

WORMLEYSBURG

-

Population: 3,070

-

Median household income: $53,617

-

School tax: 9 mills

-

County tax: 2.04 mills

-

Municipal tax: 3.06 mills

-

Total tax: 14.1 mills

-

Common level ratio *: 100 percent

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,410

-

Median value house: $146,300

-

Assessed value on median house: $146,300

-

Tax on median house: $2,063

*Common level ratio compares the market value to the assessed value of a home.

PERRY COUNTY

DUNCANNON

-

Population: 1,522

-

Median household income: $41,932

-

School tax: 12.2 mills

-

County tax: 3.31 mills

-

Municipal tax: 3.1 mills

-

Total tax: 18.61 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,861

-

Median value house: $102,100

-

Assessed value on median house: $102,100

-

Tax on median house: $1,900

MARYSVILLE

-

Population: 2,534

-

Median household income: $45,754

-

School tax: 12.2 mills

-

County tax: 3.3 mills

-

Municipal tax: 2 mills

-

Total tax: 17.5 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,750

-

Median value house: $121,300

-

Assessed value on median house: $121,300

-

Tax on median house: $2,123

NEW BUFFALO

-

Population: 129

-

Median household income: $41,250

-

School tax: 12.2 mills

-

County tax: 3.31 mills

-

Municipal tax: 1.3 mills

-

Total tax: 16.81 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,681

-

Median value house: $126,800

-

Assessed value on median house: $126,800

-

Tax on median house: $2,132

PENN TOWNSHIP

-

Population: 3,225

-

Median household income: $49,804

-

School tax: 12.2 mills

-

County tax: 3.31 mills

-

Municipal tax: .57 mills

-

Total tax: 16.08 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,608

-

Median value house: $129,200

-

Assessed value on median house: $129,200

-

Tax on median house: $2,078

RYE TOWNSHIP

-

Population: 2,364

-

Median household income: $71,801

-

School tax: 12.2 mills

-

County tax: 3.31 mills

-

Municipal tax: .9 mills

-

Total tax: 16.41 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,641

-

Median value house: $166,200

-

Assessed value on median house: $166,200

-

Tax on median house: $2,727

WATTS TOWNSHIP

-

Population: 1,311

-

Median household income: $53,235

-

School tax: 12.2 mills

-

County tax: 3.31 mills

-

Fire tax: .22

-

Municipal tax: .43 mills

-

Total tax: 16.16 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,616

-

Median value house: $143,500

-

Assessed value on median house: $143,500

-

Tax on median house: $2,319

WHEATFIELD TOWNSHIP

-

Population: 3,334

-

Median household income: $62,333

-

School tax: 12.2 mills

-

County tax: 3.3 mills

-

Municipal tax: .2 mills

-

Total tax: 15.7 mills

-

Common level ratio: 100 percent*

-

Assessed value of $100,000 house: $100,000

-

Tax on $100,000 market value house: $1,570

-

Median value house: $142,000

-

Assessed value on median house: $142,000

-

Tax on median house: $2,229

*Common level ratio compares the market value to the assessed value of a home

YORK COUNTY

CARROLL TOWNSHIP

-

Population: 5,939

-

Median household income: $70,133

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.62 mills

-

Total tax: 20.38 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,712

-

Median value house: $225,600

-

Assessed value on median house: $189,504

-

Tax on median house: $3,862

DILLSBURG

-

Population: 2,563

-

Median household income: $51,045

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: 2.37 mills

-

Total tax: 21.13 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,775

-

Median value house: $148,500

-

Assessed value on median house: $124,740

-

Tax on median house: $2,636

FAIRVIEW TOWNSHIP

-

Population: 16,668

-

Median household income: $71,472

-

School tax: 11.78 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.6 mills

-

Total tax: 17.53 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,473

-

Median value house: $187,600

-

Assessed value on median house: $157,584

-

Tax on median house: $2,762

FRANKLINTOWN

-

Population: 489

-

Median household income: $40,938

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.88 mills

-

Total tax: 20.64 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,734

-

Median value house: $134,100

-

Assessed value on median house: $112,644

-

Tax on median house: $2,325

FRANKLIN TOWNSHIP

-

Population: 4,678

-

Median household income: $60,850

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: .2 mills

-

Total tax: 18.96 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,593

-

Median value house: $174,800

-

Assessed value on median house: $146,832

-

Tax on median house: $2,784

GOLDSBORO

-

Population: 952

-

Median household income: $65,865

-

School tax: 11.78 mills

-

County tax: 4.15 mills

-

Municipal tax: .75 mills

-

Total tax: 16.68 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,401

-

Median value house: $143,800

-

Assessed value on median house: $120,792

-

Tax on median house: $2,015

LEWISBERRY

-

Population: 362

-

Median household income: $66,250

-

School tax: 11.78 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.3 mills

-

Total tax: 17.23 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,447

-

Median value house: $154,200

-

Assessed value on median house: $129,528

-

Tax on median house: $2,232

MONAGHAN TOWNSHIP

-

Population: 2,630

-

Median household income: $73,977

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: .9 mills

-

Total tax: 19.66 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,651

-

Median value house: $210,300

-

Assessed value on median house: $176,652

-

Tax on median house: $3,473

NEWBERRY TOWNSHIP — DISTRICT 1

-

Population (District 1 and 2): 15,285

-

Median household income (District 1 and 2): $56,047

-

School tax: 11.78 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.79 mills

-

Total tax: 17.72 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,448

-

Median value house (District 1 and 2): $127,500

-

Assessed value on median house: $107,100

-

Tax on median house: $1,898

NEWBERRY TOWNSHIP — DISTRICT 2

-

Population (see District 1): 15,285

-

Median household income (see District 1): $56,047

-

School tax: 23.72 mills

-

County tax: 4.15 mills

-

Municipal tax: 1.79 mills

-

Total tax: 29.66 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $2,491

-

Median value house (see District 1): $127,500

-

Assessed value on median house: $107,100

-

Tax on median house: $3,177

WARRINGTON TOWNSHIP

-

Population: 4,773

-

Median household income: $58,958

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: .21 mills

-

Total tax: 18.97 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,593

-

Median value house: $177,900

-

Assessed value on median house: $149,436

-

Tax on median house: $2,835

WELLSVILLE

-

Population: 221

-

Median household income: $51,250

-

School tax: 14.61 mills

-

County tax: 4.15 mills

-

Municipal tax: .42 mills

-

Total tax: 19.18 mills

-

Common level ratio *: 84 percent

-

Assessed value of $100,000 house: $84,000

-

Tax on $100,000 market value house: $1,611

-

Median value house: $153,800

-

Assessed value on median house: $129,192

-

Tax on median house: $2,478

*Common level ratio compares the market value to the assessed value of a home.

LEBANON COUNTY

ANNVILLE TOWNSHIP

-

Population: 4,767

-

Median household income: $51,250

-

School tax: 102.76 mills

-

County tax: 20 mills

-

Municipal tax: 20 mills

-

Total tax: 142.76 mills

-

Common level ratio: 15.8 percent*

-

Assessed value of $100,000 house: $15,800

-

Tax on $100,000 market value house: $2,251

-

Median value house: $131,400

-

Assessed value on median house: $20,761

-

Tax on median house: $2,958

EAST HANOVER TOWNSHIP

-

Population: 2,801

-

Median household income: $58,840

-

School tax: 86.85 mills

-

County tax: 20 mills

-

Municipal tax: 1.5 mills

-

Total tax: 108.35 mills

-

Common level ratio: 15.8 percent *

-

Assessed value of $100,000 house: $15,800

-

Tax on $100,000 market value house: $1,712

-

Median value house: $170,000

-

Assessed value on median house: $26,860

-

Tax on median house: $2,910

NORTH ANNVILLE TOWNSHIP

-

Population: 2,381

-

Median household income: $65,958

-

School tax: 102.76 mills

-

County tax: 20 mills

-

Municipal tax: none

-

Total tax: 122.76 mills

-

Common level ratio: 15.8 percent *

-

Assessed value of $100,000 house: $15,800

-

Tax on $100,000 market value house: $1,940

-

Median value house: $157,700

-

Assessed value on median house: $24,917

-

Tax on median house: $3,059

NORTH LONDONDERRY TOWNSHIP

-

Population: 8,068

-

Median household income: $65,000

-

School tax: 98.75 mills

-

County tax: 20 mills

-

Municipal tax: 10 mills

-

Total tax: 128.75 mills

-

Common level ratio: 15.8 percent *

-

Assessed value of $100,000 house: $15,800

-

Tax on $100,000 market value house: $2,034

-

Median value house: $192,300

-

Assessed value on median house: $30,383

-

Tax on median house: $3,912

PALMYRA

-

Population: 7,320

-

Median household income: $48,750

-

School tax: 98.75 mills

-

County tax: 20 mills

-

Municipal tax: 17.50 mills (includes .5 library)

-

Total tax: 136.25 mills

-

Common level ratio: 15.8 percent*

-

Assessed value of $100,000 house: $15,800

-

Tax on $100,000 market value house: $2,153

-

Median value house: $140,000

-

Assessed value on median house: $22,120

-

Tax on median house: $3,014

SOUTH ANNVILLE TOWNSHIP

-

Population: 2,850

-

Median household income: $63,289

-

School tax: 102.76 mills

-

County tax: 20 mills

-

Municipal tax: 6 mills

-

Total tax: 128.76 mills

-

Common level ratio: 15.8 percent*

-

Assessed value of $100,000 house: $15,800

-

Tax on a $100,000 house: $2,034

-

Median value house: $166,900

-

Assessed value on median house: $26,370

-

Tax on median house: $3,395

SOUTH LONDONDERRY TOWNSHIP

-

Population: 6,991

-

Median household income: $78,105

-

School tax: 98.75 mills

-

County tax: 20 mills

-

Municipal tax: 10.5 mills (include. 1.5 fire)

-

Total tax: 129.25 mills

-

Common level ratio: 15.8 percent*

-

Assessed value of $100,000 house: $15,800

-

Tax on a $100,000 house: $2,042

-

Median value house: $209,000

-

Assessed value on median house: $33,022

-

Tax on median house: $4,268

*Common level ratio compares the market value to the assessed value of a home

DAUPHIN COUNTY

CONEWAGO TOWNSHIP

-

Population: 2,997

-

Median household income: $84,844

-

School tax: 18.42 mills

-

County tax: 6.88 mills

-

Municipal tax: none

-

Library tax: .35 mills

-

Total tax: 25.65 mills

-

Common level ratio: * 73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,885

-

Median value house: $228,700

-

Assessed value of median house: $168,094

-

Tax on median house: $4,311

DERRY TOWNSHIP

-

Population: 24,679

-

Median household income: $60,635

-

School tax: 16.99 mills

-

County tax: 6.88 mills

-

Municipal tax: 1.1 mills

-

Library tax: None

-

Total tax: 24.97 mills

-

Common level ratio: * 73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,835

-

Median value house: $226,500

-

Assessed value on median house: $166,477

-

Tax on median house: $4,157

EAST HANOVER TOWNSHIP

-

Population: 5,718

-

Median household income: $58,427

-

School tax: 18.42 mills

-

County tax: 6.88 mills

-

Municipal tax: .36 mills

-

Library tax: .35 mills

-

Total tax: 26.01 mills

-

Common level ratio: * 73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,912

-

Median value house: $161,300

-

Assessed value on median house: $118,555

-

Tax on median house: $3,084

HARRISBURG

-

Population: 49,528

-

Median household income: $31,676

-

School tax: 26.31 mills

-

County tax: 6.88 mills

-

Municipal tax: 4.78 buildings, 28.6 land

-

Library tax: .35 mills

-

Total tax: 37.97 mills on buildings, 61.79 mills on land

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $57,733 buildings, $15,767 land

-

Tax on $100,000 market value house: $3,194

-

Median value house: $78,400

-

Assessed value on median house: $45,318 buildings, $12,377 land

-

Tax on median house: $2,506

HIGHSPIRE

-

Population: 2,399

-

Median household income: $37,038

-

School tax: 24.84 mills

-

County tax: 6.88 mills

-

Municipal tax: 14.3 mills

-

Library tax: .35 mills

-

Total tax: 46.37 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $3,408

-

Median value house: $88,400

-

Assessed value on median house: $64,974

-

Tax on median house: $3,013

HUMMELSTOWN

-

Population: 4,538

-

Median household income: $55,888

-

School tax: 18.42 mills

-

County tax: 6.88 mills

-

Municipal tax: 2 mills

-

Library tax: .35 mills

-

Total tax: 27.65 mills

-

Common level ratio: * 73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,032

-

Median value house: $150,500

-

Assessed value on median house: $110,617

-

Tax on median house: $3,059

LONDONDERRY TOWNSHIP

-

Population: 5,235

-

Median household income: $66,742

-

School tax: 18.42 mills

-

County tax: 6.88 mills

-

Municipal tax: 3 mills

-

Library tax: .35 mills

-

Total tax: 28.65 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,106

-

Median value house: $131,800

-

Assessed value on median house: $96,873

-

Tax on median house: $2,775

LOWER PAXTON TOWNSHIP

-

Population: 47,360

-

Median household income: $62,855

-

School tax: 13.86 mills

-

County tax: 6.88 mills

-

Municipal tax: .96 mills

-

Library tax: .35 mills

-

Total tax: 22.05 mills

-

Common level ratio: * 73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,620

-

Median value house: $166,900

-

Assessed value on median house: $122,671

-

Tax on median house: $2,705

LOWER SWATARA TOWNSHIP

-

Population: 8,268

-

Median household income: $60,553

-

School tax: 20.99 mills

-

County tax: 6.88 mills

-

Municipal tax: 2.5 mills

-

Library tax: .35 mills

-

Total tax: 30.72 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,258

-

Median value house: $137,400

-

Assessed value on median house: $100,989

-

Tax on median house: $3,102

MIDDLETOWN

-

Population: 8,901

-

Median household income: $47,522

-

School tax: 20.99

-

County tax: 6.88

-

Municipal tax: 5.63

-

Total tax: 33.5 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,462

-

Median value house: $110,600

-

Assessed value on median house: $81,291

-

Tax on median house: $2,723

PAXTANG

-

Population: 1,561

-

Median household income: $56,250

-

School tax: 13.86 mills

-

County tax: 6.88 mills

-

Municipal tax: 10.73 mills

-

Library tax: .35 mills

-

Total tax: 31.82 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,339

-

Median value house: $136,900

-

Assessed value on median house: $100,621

-

Tax on median house: $3,202

PENBROOK

-

Population: 3,008

-

Median household income: $36,545

-

School tax: 13.86 mills

-

County tax: 6.88 mills

-

Municipal tax: 9.2 mills

-

Library tax: .35 mills

-

Total tax: 30.29 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,226

-

Median value house: $99,900

-

Assessed value on median house: $73,426

-

Tax on median house: $2,224

ROYALTON

-

Population: 967

-

Median household income: $46,719

-

School tax: 20.99 mills

-

County tax: 6.88 mills

-

Municipal tax: 3 mills

-

Library tax: .35 mills

-

Total tax: 31.22 mills

-

Common level ratio: *$73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $2,295

-

Median value house: $97,900

-

Assessed value on median house: $71,956

-

Tax on median house: $2,246

SOUTH HANOVER TOWNSHIP

-

Population: 6,248

-

Median household income: $87,050

-

School tax: 18.42 mills

-

County tax: 6.88 mills

-

Municipal tax: .46 mills

-

Library tax: .35 mills

-

Total tax: 26.11 mills

-

Common level ratio: *73.5

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,919

-

Median value house: $222,700

-

Assessed value on median house: $163,684

-

Tax on median house: $4,274

STEELTON

-

Population: 5,990

-

Median household income: $35,048

-

School tax: 24.84 mills

-

County tax: 6.88 mills

-

Municipal tax: 14 mills

-

Library tax: .35 mills

-

Total tax: 46.07 mills

-

Common level ratio: * 73.5

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $3,386

-

Median value house: $78,600

-

Assessed value on median house: $57,771

-

Tax on median house: $2,569

SUSQUEHANNA TOWNSHIP

-

Population: 24,036

-

Median household income: $58,965

-

School tax: 16.43 mills

-

County tax: 6.88 mills

-

Municipal tax: 2.6 mills

-

Library tax: .35 mills

-

Total tax: 26.26 mills

-

Common level ratio: *$73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,930

-

Median value house: $155,900

-

Assessed value on median house: 114,586

-

Tax on median house: $3,009

SWATARA TOWNSHIP

-

Population: 23,362

-

Median household income: $54,110

-

School tax: 13.86 mills

-

County tax: 6.88 mills

-

Municipal tax: 2.32 mills

-

Library tax: .35 mills

-

Total tax: 23.41 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,720

-

Median value house: $145,100

-

Assessed value on median house: $106,648

-

Tax on median house: $2,497

WEST HANOVER TOWNSHIP

-

Population: 9,343

-

Median household income: $68,085

-

School tax: 13.86 mills

-

County tax: 6.88 mills

-

Municipal tax: 1.19 mills

-

Library tax .35 mills

-

Total tax: 22.28 mills

-

Common level ratio: *73.5 percent

-

Assessed value of $100,000 house: $73,500

-

Tax on $100,000 market value house: $1,638

-

Median value house: $175,600

-

Assessed value on median house: $129,066

-

Tax on median house: $2,875

*Common level ratio compares the market value to the assessed value of a home.

Search all Harrisburg PA homes for sale.

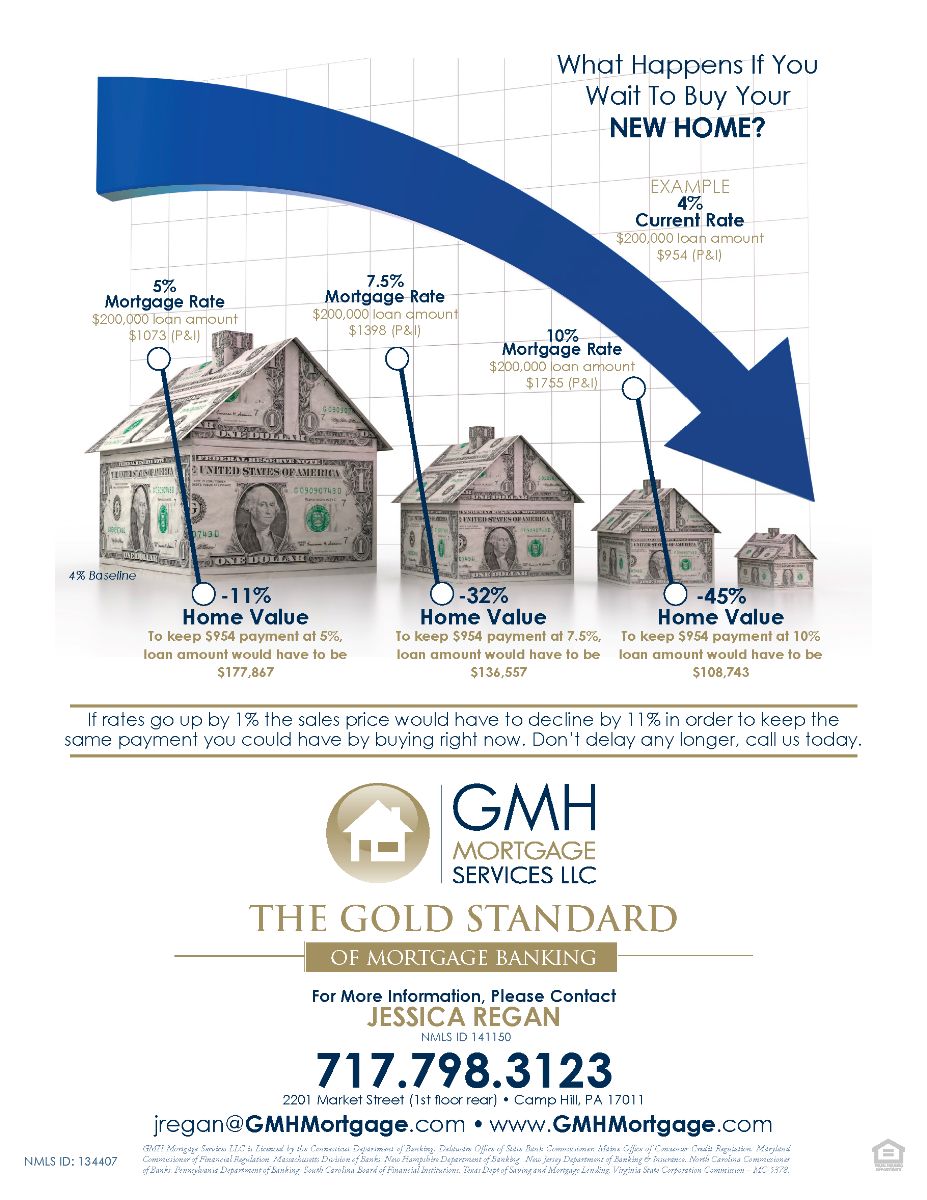

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.