Is It A Good time To Buy Or Sell A Harrisburg PA Home? Or Maybe Just Refinance?

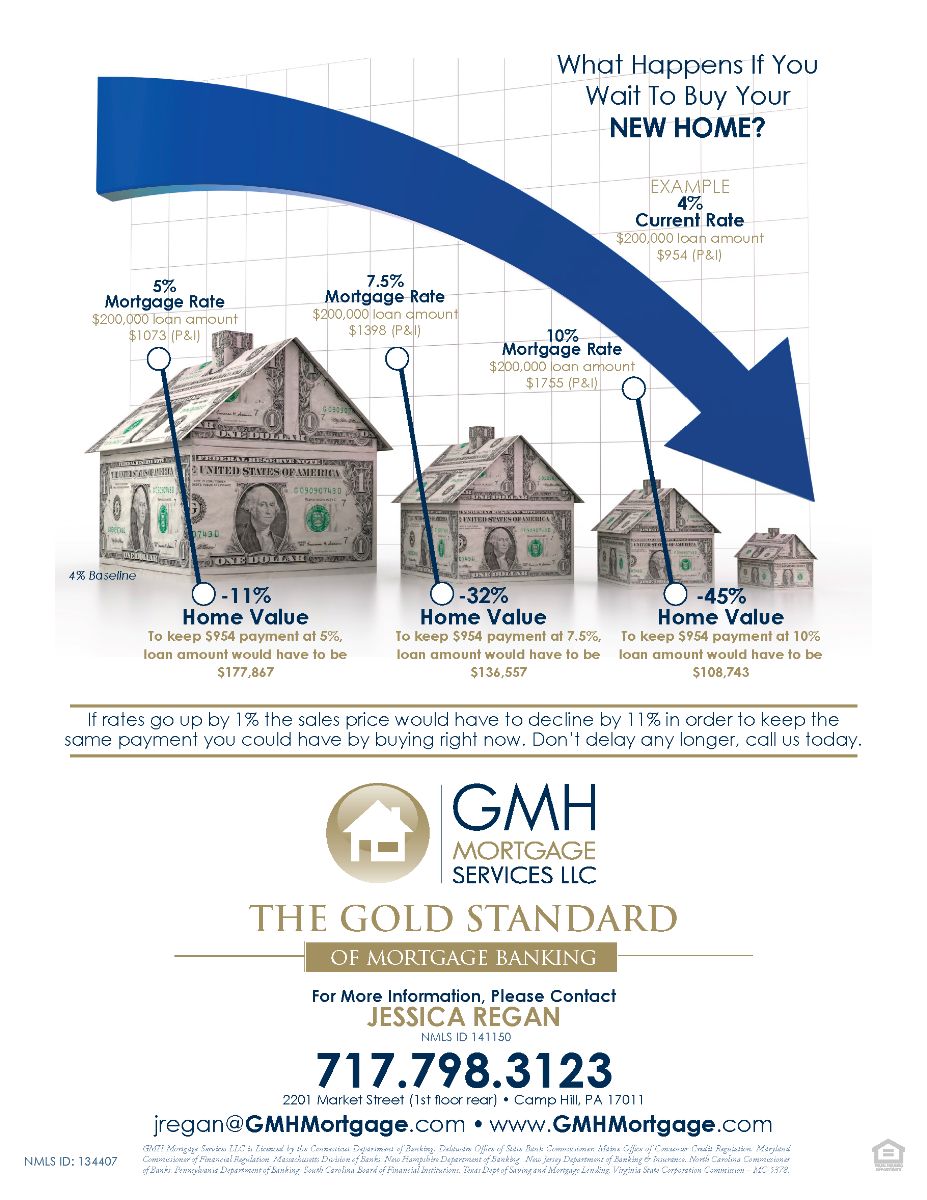

We all have seen reports and indications from many sources and I have even stated it is a good time to buy your next Harrisburg PA home because of the low mortgage interest rates and the abundance of good quality homes that are currently for sale. But what about the home owner that doesn’t want to move and I am not going to list all the reasons that a homeowner does not want to move, they are too numerous. So if you are not considering a move does refinancing the existing mortgage on your Harrisburg PA home make sense? In many, many cases the answer would be yes. There is no magical dollar amount that you owe formula because every situation is different and the dynamics of every homeowner is different. There are many excellent lenders that I know that are willing and extremely able to determine whether a refinance is worth your while and most importantly save you some of your hard earned money.

If by any chance you are considering the purchase of a home and would like to know what is available in all the areas please visit my web site, www.DonRoth.com, and click the search listings tab and you will find the most up to date information available. Or you can contact me and I would be willing to create a Neighborhood Activity Report based on your criteria.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.