Disappointing Jobs Growh Report - July 2011

"HE THAT SPEAKS MUCH, IS MUCH MISTAKEN." Those words by Benjamin Franklin rang true last week, after a report earlier in the week had the markets buzzing about the potential for a strong Jobs Report... only to have those expectations crash at week's end. Here's what happened and how it impacted Bonds and home loan rates.

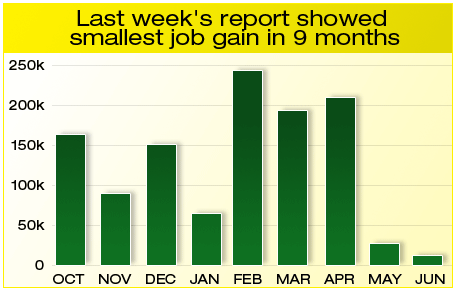

Major shocker. According to the Labor Department's "Non-Farm Payroll" Jobs Report, only 18,000 jobs were gained during the month of June. That number was significantly below the recently upwardly revised gain of 125,000 new jobs that were expected, and showed employers hiring the fewest number of workers in 9 months.

Major shocker. According to the Labor Department's "Non-Farm Payroll" Jobs Report, only 18,000 jobs were gained during the month of June. That number was significantly below the recently upwardly revised gain of 125,000 new jobs that were expected, and showed employers hiring the fewest number of workers in 9 months.

Unemployment ticks up. The Unemployment Rate was also a disappointment, rising from 9.1% to 9.2%. While this facet of the report isn't unexpected - as the Unemployment Rate can rise as more people re-enter the labor market in "job seeker" mode - the overall disappointing report re-ignites fears that the economic recovery is slowing and remains a bit stagnant.

Is there a silver lining? There was one somewhat bright spot in the Jobs Report. All of the job gains came from the private sector, with government agencies being the ones losing jobs as they deal with budget pressures. So while gains have slowed, the growth that exists is at least coming from the private sector.

Why were expectations so high? Just one day before the Jobs Report was released, the markets saw the ADP Employment Report, which was far better than anyone expected. Instead of the 60,000 job gains that were expected, the report showed 157,000 jobs added in June. That pleasant surprise boosted Stocks... and also boosted expectations that the Jobs Report would come in better than expected too.

In addition, the weekly Initial Jobless Claims Report also gave the markets a positive outlook on employment, as the report showed a decrease in the number of new unemployment claims. Although the number was still above the important 400,000 mark, it indicated that the previous week's higher number could have been an "anomaly" week - with the July 4th holiday slowing down the count for many states as well as Minnesota's state government shutting down and forcing several thousand state employees to file claims themselves.

Speaking of Minnesota, the state may serve as a warning. In the wake of the state government shutdown, many political and market experts are looking to Minnesota as a glimpse of what could happen at the federal level if Congress and the White House can't reach an agreement. The political climate in the state has mirrored what is happening on the federal level, as the battle continues over a budget deal. And just last week, Fitch Ratings has downgraded Minnesota's debt rating, which means the State will need to pay higher interest rates to investors due to increased risk. No matter how you look at the situation, it's not a pretty picture of what happens when compromise isn't reached.

Overall, the news last week led to volatility both in expectations and in market movement. In the end, Bonds made some strong gains at the end of the week to help home loan rates finish strong. That means rates are still near historic lows and represent a great opportunity. Call or email to see how the situation may benefit you.