Up For a New Year?

As we approach the end of the old year nearly all of us stop to ask, “How will the new year unfold?” Of course, none of us know with any certainty the answer to that question, but it can be insightful (and fun) to ponder. So, how will 2012 unfold, at least as it pertains to the housing and mortgage markets?

Both markets will obviously be influenced by economic growth, which, in turn, will spur job growth. We see a pick up in economic growth and job growth in 2012.The economy has been growing at a sluggish rate for too long now. The United States is unique in that Americans tire of pessimism quicker than most other cultures, and then we do something about it. In our opinion, rising consumer confidence points to a lot of pent-up demand that is waiting to bust loose, and will bust loose in 2012.

A pick up in demand, in turn, necessitates new hires. In fact, a recent survey by CareerBuilder.com found that nearly one in four employers is keen to add new permanent full-time employees. These employers are simply waiting for a clear sign the coast is clear. We think they will get that sign in the first quarter of 2012.

Greater economic activity will obviously impact the housing market. We see accelerated sales volume in both the new and existing home markets. We also expect to see prices stabilize in the first half of the year, and then appreciate perceptibly in the second half.

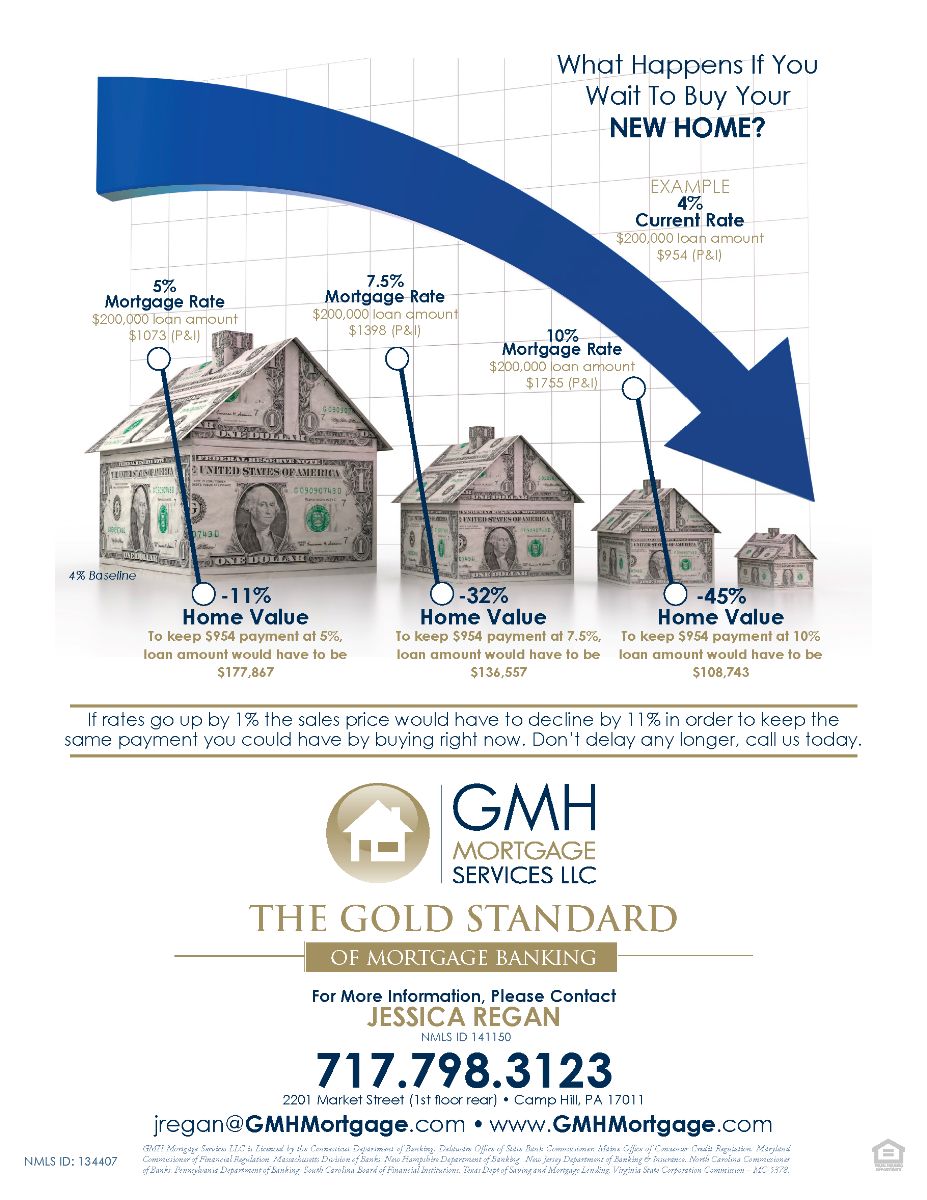

As for the mortgage market? This is much more difficult to call. The Federal Reserve has stated it intends to hold rates low through 2012. However, all it takes are a few persuasive signs that the economy is back on track, and the Fed could easily backtrack from its stated goals. All we can say is that we would be much less surprised to see mortgage rates 50 basis points higher six months from today than 50 basis points lower.

Courtesy of Jessica Regan.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.