Central Pennsylvania 2008 Third Quarter Real Estate Report

Central Pennsylvania 2008 Third Quarter Real Estate Report

As we are experiencing Indian Summer, we in Central Pennsylvania are seeing the extremes in the stock markets. With all the turmoil occurring in all areas, especially financials, many of us are wondering are we ever going to return to the prosperous times of just two years ago. In my opinion, things will get better but the timing is the uncertain element that we face.

Many people are blaming the banks, investment banks and the government for the financial mess we are facing and I cannot argue with these opinions. Many homeowners are facing serious consequences throughout the country because of job loss, buying at the peak of a specific real estate market or other similar issues. We in the greater Harrisburg area have not completely escaped this real estate market correction, but we have fared much, much better than a lot of the country has.

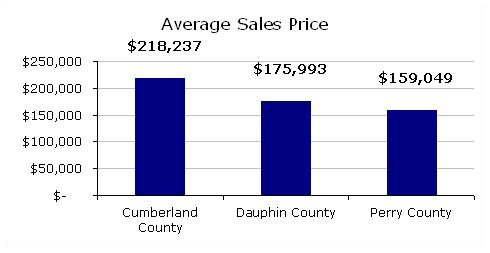

With that in mind, here is some good news for homeowners in the area. Yes, the number of home sold as reported by the Central Penn Multi List decreased by almost 12% in the third quarter of 2008 compared the same period in 2007. And the average sales price of $194,074 in the same period for 2008 decreased by only 1.5% compared to 2007, but the average compared to the third quarter of 2006 has increased by almost $8000 and, according to the Central Penn report, 2006 had the most homes ever sold in our area. And the time an average home takes to be placed under contract has increased slightly to 70 days, which is a far cry from historical data of 90 to 110 days.

What does that mean to the people that are looking to buy or sell a home? First and probably foremost, there is mortgage money available for buyers contemplating a purchase of a home. Yes the credit standards must have increased slightly – you may need a slightly higher credit score – but when I asked a lender last week what happens when a buyer has good credit score and money to put down on a home, she said when do they need the mortgage money. Why in this area is money available? Investors look at Central Pennsylvania as a stable area that has not be affected by the severe highs and lows of the real estate markets experienced in states such as California, Nevada, Arizona and Florida. And yes, there has been an increase in foreclosures in our market but fortunately these foreclosures have not negatively impacted the value of whole communities. And there are more homes available for sale than there has been but homes are still selling in these times. How you ask? Home buyers are looking for value, not to steal a home, and sellers are looking for a return on their investment and in some instances these two goals have not hit the equilibrium point but I don’t think we are too far from there today. So there are going to be challenging times going forward, but we will recover in the future and real estate still be a great investment. Maybe I am pie in the sky – I don’t think so and I am waiting for the time when buyers and sellers are happy that they have the opportunity to buy and sell real estate.