It's Not Too Late - Foreclosure Mediation Program May Help

You probably figure if your house is being foreclosed on in county court, it’s too late.

Not so, if Cumberland County Court President Judge Kevin Hess has his way. Read this article from PennLive.com...

Hess wants to start a foreclosure mediation program similar to divorce mediation, where the court uses its power to bring parties together one last time to work things out — in this case to avoid someone losing their home.

Nobody wins in a foreclosure, including banks that don’t want to own the properties, Hess said.

Some states, including New York, have laws requiring a settlement conference between the mortgage holder and homeowner before a property can be foreclosed on and sold.

Pennsylvania has no such law, although legislation has been introduced that would make every county court in the state establish a foreclosure mediation program.

For now, each county is free to decide whether to have foreclosure mediation. The state Supreme Court is encouraging counties establish foreclosure mediation and Hess said he was motivated to start a program in Cumberland after attending a conference on foreclosure mediation in October.

Cumberland would be the first midstate county court with foreclosure mediation. Neither Lebanon, Perry nor York counties offer the program.

Dauphin County Court Administrator Carolyn Thompson said county judges considered starting a mediation program in 2008-09 after Philadelphia established a program. Dauphin formed a task force to study the issue and sent staff to a state Supreme Court workshop.

“Ultimately, however, our review of the dockets revealed that our numbers of foreclosure filings had not taken, and still have not taken, the dramatic upturn that other areas of the state may have seen,” Thompson said. Because of the advance work Dauphin has done, Thompson said the county could quickly have foreclosure mediation in place if numbers warrant.

Cumberland’s program would likely mirror those of other Pennsylvania counties, where filing foreclosure in court triggers the issuance of a notice of a mediation program to the homeowner.

The homeowner has a certain amount of time to contact a housing counselor designated by the county, leading to the setting up of a conference between a representative of the mortgage holder, the homeowner and the counselor.

The foreclosure is then put on hold pending outcome of the conference. Mediation often involves several conferences over months.

Conferences are usually presided over by a court official, be it someone the county appoints similar to a divorce master, or a judge. In some counties lawyers are available to homeowners pro bono if the homeowner can’t afford representation.

Except for Philadelphia, where mediation is automatic when a foreclosure is filed, mediation only takes place in other Pennsylvania counties if the homeowner requests a conference.

As a result the potential benefit of court mediation is less than it could be because of low participation rates by homeowners, in part due to time limits imposed on homeowners to request a conference and submit required documents, said Geoff Walsh, a staff attorney with the National Consumer Law Center who tracks foreclosure mediation programs.

Walsh in a September 2009 report said the effectiveness of court foreclosure mediation was undercut by the balance of power favoring the mortgage holder at the expense of the homeowner. He also noted a lack of reporting requirements for counties with foreclosure mediation, making it hard to assess value of the programs.

Since Lackawanna County court started foreclosure mediation two years ago, 53 percent of cases where homeowners request mediation have been successful, with agreements between the mortgage holder and homeowner and voluntary dismissal of the foreclosure action, according to county Judge Terrence Nealon, who runs the program.

Another 30 percent of cases are pending due to negotiations or temporary agreements, while 17 percent failed and the mortgage holder proceeded with foreclosure.

Nealon said the most common successful outcome is where a lender agrees to restructure the mortgage at a lower interest rate, often combined with extending the term.

“It’s not a program trying to have people live in homes free of charge. It’s a dual goal of keeping people in their home but making the loans performing again under terms [the homeowner] can satisfy,” Nealon said.

By the numbers

Here are the numbers for mortgage foreclosure cases filed in midstate county courts for 2011 so far, compared to full-year numbers for 2010 and 2009.

Cumberland County

2011 year to date: 182

2010: 561

2009: 538

Dauphin County

2011 year to date: 296

2010: 962

2009: 1,011

Lebanon County

2011 year to date: 131

2010: 383

2009: 334

Perry County

2011 year to date: 53

2010: 142

2009: 130

York County

2011 year to date: 588

2010: 2,080

2009: 2,142

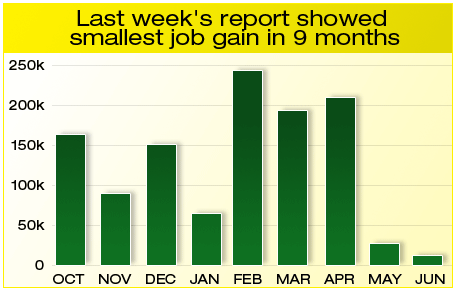

Major shocker. According to the Labor Department's "Non-Farm Payroll" Jobs Report, only 18,000 jobs were gained during the month of June. That number was significantly below the recently upwardly revised gain of 125,000 new jobs that were expected, and showed employers hiring the fewest number of workers in 9 months.

Major shocker. According to the Labor Department's "Non-Farm Payroll" Jobs Report, only 18,000 jobs were gained during the month of June. That number was significantly below the recently upwardly revised gain of 125,000 new jobs that were expected, and showed employers hiring the fewest number of workers in 9 months.